A Better Way to Trade

DerivaDEX provides a new standard for trading - combining performance with transparency and user-empowerment. While the products and usability of decentralized finance have advanced significantly, the industry remains stuck in a cycle where capital recirculates within a small, crypto-native user base, limiting its impact. The promise of sustainable liquidity, diversity of participants, and truly global financial markets remains unfulfilled.

DerivaDEX aims to change that. It’s a decentralized derivatives platform supporting user-empowered, p2p trading of crypto perpetual swaps, and makes these features accessible to users outside DeFi through a combination of high-performance execution and security.

Breaking the DeFi Cycle

DeFi is locked in a boom-and-bust cycle, driven by the same small pool of crypto-native users moving their capital from one protocol to another. This limits the potential of DeFi to mature into a stable, global market. Capital inflows have increased from cycle to cycle, but growth in the user base has not kept apace. This results in liquidity constraints and a lack of market stability. A broader, more diverse user base is essential to maintain the liquidity needed to support fair and efficient markets.

To achieve this, DerivaDEX is designed to enable adoption beyond the crypto-native space. DerivaDEX unites high-performance architecture with safety and compliance to support the needs of CeFi users and institutional traders. Every product decision is guided by the mission to onboard new participants, unlock new liquidity, and stabilize decentralized trading.

Why It Matters

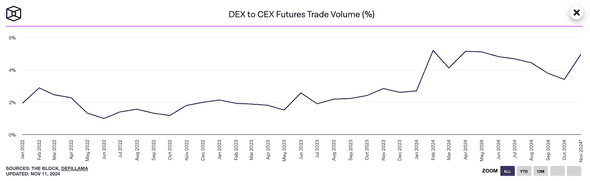

Trading cryptocurrencies enables users to express complex opinions on new types of software, new directions for research and to build sustainable positions that are more resilient to market movements. Right now, the vast majority of users do this via a handful of centralized platforms. These platforms support daily trading volumes ranging from $90-200 billion, vastly surpassing decentralized platforms where DeFi perpetuals account for just 3-5% of total trading volume.

Traders on DeFi platforms, in many cases, also have different objectives and strategies in their trading compared to users of a centralized platform. This concentration of user types in DeFi limits the diversity of market participants and narrows the range of opinions and positions that drive market movements.

DerivaDEX aims to change this. With DerivaDEX, traders can enjoy execution speeds comparable with those of leading centralized platforms, while benefiting from the security, user control, and transparency of a decentralized platform. This high-performance, liquid, and secure platform is built to meet the needs of a broader audience, including those who demand centralized platform-level speed and a durable compliance strategy. In doing so, DerivaDEX will onboard traders new to DeFi, support a wider range of trading strategies and provide the sustainable liquidity necessary to stabilize and grow the web3 ecosystem.

Approach

DerivaDEX provides more durability and performance than decentralized platforms, and offers more transparency and user alignment than centralized platforms. To do this, DerivaDEX starts from the product requirements of a derivatives platform, and uses cryptographic technologies that are best fit for this use case. DerivaDEX holistically addresses predatory market behaviors and MEV misalignments, withdrawal times, custodial risk, latency, price oracle fragility, integration friction, and high transactional costs.

The following principles are foundational to a derivatives platform that will break out of the DeFi cycle, and provide better, more innovative solutions than centralized alternatives:

Performance

Efficiency and speed in all operations

Performance is key to unlocking sustainable liquidity. Performance is directly limited by the concept of “finality”. Centralized platforms achieve instant finality, because they do not depend on a blockchain so a transaction is as fast as the platform itself. Decentralized platforms cannot achieve finality that is faster than their block time.

Traders on centralized platforms care about acknowledgement-time (ack-time): the speed at which a request is acknowledged by the platform. Non-instant finality on decentralized platforms limits this ack-time to uncompetitive levels with respect to leading centralized platforms. This creates a negative impact on the types of trading and strategies that can be supported across various market environments, reinforcing the more narrow trader profile seen on DeFi platforms.

DerivaDEX, in contrast, offers sub-5ms ack-time latencies, deposits in about 1 minute, withdrawals within 10 minutes, and a real-time price feed. The platform’s matching process is managed by offline nodes, doubling as price oracles safeguarded by trusted execution environments (TEEs). This permits the use of streamlined Raft consensus—a fast and efficient consensus mechanism– to achieve speed and security with minimal network overhead.

With this unique approach, DerivaDEX matches the finality of centralized platforms while maintaining the trust model of decentralization.

Front-running resistance

Prevents predatory access to user orders and preserves fairness

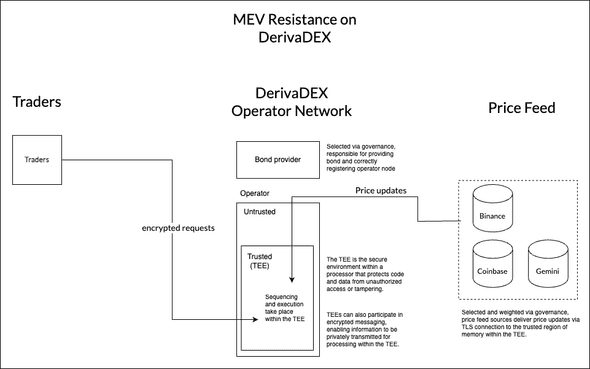

DerivaDEX achieves front-running resistance by employing request sequencing and execution within trusted hardware secure enclaves (TEEs). Orders are encrypted client-side, until they are sequenced and decrypted for execution within the enclave. Neither chain observers nor node operators are able to view or affect these incoming requests. This mitigates MEV opportunities around transaction reordering, tampering, and information leakage.

DerivaDEX mitigates MEV on two fronts: incoming requests from traders, as well as by preventing price feed manipulation by operator nodes. Both aspects utilize the tamper resistance and encryption tools that are part of the TEE architecture.

Additionally, DAO-based governance ensures open and transparent governance for all decisions, including decisions like: asset listings, fee determinations, leverage limits and new trading products. This is an improvement over the closed-door policies and decision making of centralized platforms.

Non-Custodial funds

Users must control their own funds

DerivaDEX is a non-custodial platform that uses audited smart contracts on Ethereum for its strong trust model and network effect. These contracts are how the state of the platform (a sparse Merkle tree) is settled, ensuring users retain control over their funds without centralized intermediaries.

Additional protocol and application layer safety, such as rate limits and governance queuing delays bolster security.

This approach to noncustodial funds is also key to platform composability within the broader ecosystem. DerivaDEX provides other Ethereum-based applications with near real-time insight and access to platform data and liquidity without relying on third-party interoperability infrastructure or bridges.

Risk management

Protect users against adversarial market behaviors

DerivaDEX has implemented due diligence screening, and embedded safety controls like leverage limits, governance delays, anti-market manipulation safeties, and circuit breakers as deterministic execution within trusted hardware to create a safer marketplace for all market participants.

These elements are intended to build a safer, more scalable platform that is capable of competing with and exceeding the experience of centralized platforms while providing for consumer protections.

User experience

Provide a seamless experience for users

Centralized platforms typically lack transparency, verifiability, and self-custody options, while decentralized platforms often use automated market makers (AMM) models unsuitable for large orders and price moves. Decentralized platforms also may face a combination of manipulation, high fees, unconventionally designed order systems, and performance limitations.

DerivaDEX offers traders familiar with centralized platforms a familiar central-limit order book, comprehensive API, low transaction fees, and no gas fees, while also introducing powerful features like transparency, verifiability, self-custody, and composability.

Rewards

Foster an efficient marketplace for decision making

Rewards support a sustainable governance model. Governance allows communities to shape the platform’s future through efficient decision-making.

Centralized platforms have opaque and internal decision-making mechanisms that can lead to subpar reward alignment with their users. Evidence of this can be found in front-run asset listings, and unilateral decision making around fee schedules and the capitalization of insurance funds.

Decentralized platforms often have front-loaded reward programs driving inorganic and non-durable usage, and that don't promote long-term and constructive governance participation.

DerivaDEX seeks to facilitate effective governance and network security via DDX through a 10-year trade-mining reward program, along with unique wash-trading prevention mechanisms, promoting fair, equitable, and most importantly, long-term sticky usage.

Summary

DerivaDEX’s unique approach to liquidity, market risk, and accessibility provides a more stable, inclusive, and sustainable financial infrastructure. The high-performance architecture and commitment to user-driven governance offer an alternative for millions of traders currently bound to the centralized status-quo.

By onboarding users who have been hesitant to engage with DeFi, DerivaDEX isn’t just another platform; it’s the catalyst for the next phase of adoption.

Next steps

DerivaDEX’s upcoming testnet trading competition kicked off last week, and is ongoing. To get started, visit testnet. All traders can register for this competition, although prize eligibility will vary by jurisdiction.

To participate, users must undergo due diligence registration. Data collected from this process is used only for due diligence and to establish prize eligibility. A more detailed article with the objectives of the competition will be shared at the competition kickoff.

Participants who complete verification on testnet and meet mainnet eligibility criteria will benefit from an accelerated onboarding process upon mainnet launch, with most users not needing to resubmit documentation.

Mainnet onboarding will be initiated following a forthcoming governance proposal. For the latest updates on platform developments and governance proposals, join the Telegram announcements channel, follow @DDX_official on X, and subscribe to the DerivaDEX Learn email list using field below.