Rethinking DeFi's Derivatives Market Structure

The world's most sophisticated trading firms collectively invest billions of dollars to shave milliseconds off their trading times. In 2010, Spread Network spent $300 million on a fiber optic cable spanning Chicago to New York just to shave 3 milliseconds off the previous fastest route. At first glance, this improvement—about half the time it takes to snap your fingers—may seem like a silly way to spend money. After all, you could buy Beyoncé and Jay-Z's Malibu home for $200 million and still have another cool hundred million to spare.

Today however, leading trading firms measure their speed in microseconds and even nanoseconds. Meanwhile, blockchain platforms celebrate achieving 1-second transaction times as revolutionary. The fastest networks tout 250-millisecond confirmations as UX breakthroughs. This is the modern financial market equivalent of bringing a bicycle to an F1 race.

Block time versus acknowledgement time?

Block time versus acknowledgement time?

This gap becomes even more critical in derivatives markets, where leverage amplifies both opportunities and risks. While spot DEXs have made some progress with simple asset swaps, the derivatives market poses a more serious challenge.

Both traditional and blockchain platforms claim to be building the future of finance. They can't both be right.

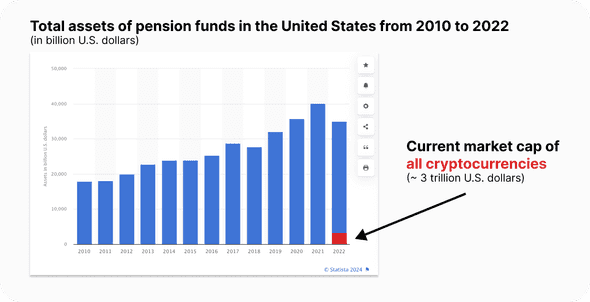

Building healthy financial systems isn't just about optimizing speed, however - it's about understanding what makes markets actually work. When a pension fund needs to trade $100 million of financial derivatives, or when a market maker needs to provide continuous liquidity across hundreds of assets, they need much more than just fast execution. They need sophisticated market structure that protects their interests while ensuring fairness for all participants.

Some market participants can be excluded from crypto markets due to the sheer size of their AUM

Some market participants can be excluded from crypto markets due to the sheer size of their AUM

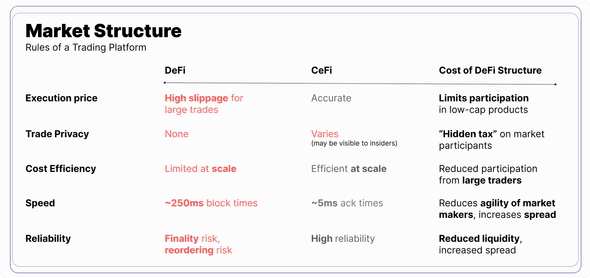

When we talk about "market structure," we mean the complete set of rules and systems that determine how trades happen on a given platform. Think of it like professional basketball—you need more than just a ball and hoop. You need rules about scoring, fouls, time limits, and court dimensions. Financial markets are no different. They need clear rules about how orders are matched, who sees what information when, and what happens if something goes wrong. Just as you wouldn't play basketball with broken rims and no referees, we shouldn't accept market structures that make trading unnecessarily expensive and unfair.

The decentralized finance industry has largely ignored these requirements from the get-go, instead focusing on overly reductive, retail-friendly interfaces and simplified trading mechanisms. But here's the paradox: by failing to serve institutional needs, these platforms actually harm the very traders they claim to protect.

Like any successful marketplace, whether it’s an Airbnb or an Amazon, crypto trading needs a diverse ecosystem to thrive. The presence of retail makes it worthwhile for institutional liquidity provisioning. What’s often overlooked, however, is that without institutional liquidity providers and professional market makers, spreads widen, slippage increases, and trading costs rise for everyone.

This fundamental misunderstanding threatens to keep decentralized finance relegated to the fringes of global markets. But it doesn't have to be this way…

The Hidden Tax of Poor Market Structure

The crypto industry has given a name to a phenomenon that has existed since the dawn of financial markets: MEV, or Maximal Extractable Value. While blockchain developers often view this as a crypto-specific problem of miners extracting value by reordering transactions, this misses the bigger picture. MEV is a fundamental market structure challenge that exists wherever order flow information can be monetized.

Consider what happens if a large mutual fund were to buy $50 million worth of Bitcoin perpetual futures. The moment they start executing, other market participants see their order and react. Prices tick up, spreads widen, and what looked like a good trade at first, becomes increasingly expensive. This isn't unique to crypto - it's the same challenge that mutual funds face in traditional markets when trying to execute large block trades of stocks.

In traditional markets, this value extraction happens through various channels: payment for order flow (where brokers sell their customers' trading intentions), co-location services (where traders pay to place their servers closer to exchanges), and even exchanges (either directly, or via a sister firm ala FTX/Alameda) theoretically acting on order flow. In blockchain transactions, it manifests more explicitly as "sandwich attacks" and frontrunning. While the mechanisms differ, the fundamental issue remains the same: market structure that allows some participants to profit from seeing others' trading intentions.

The numbers are staggering - over $280 million is extracted monthly through these practices in crypto alone. But focusing on direct, measurable extraction significantly understates the true cost. The mere existence of exploitable information asymmetries forces market makers to quote wider spreads to protect themselves, reducing liquidity and increasing trading costs for everyone. It's a hidden tax on every market participant, from retail traders to major institutions.

Think of it like trying to buy a house where every time you make an offer, not only do all other buyers instantly know what you're willing to pay, but the real estate agent themselves might use this information to their advantage. Not only would this be frustrating, but it would fundamentally change how people participate in the market - many would simply choose not to engage altogether.

This is why addressing MEV isn't just about preventing specific forms of exploitation - it's about designing a market structure that protects information and ensures fair execution for all participants. Without solving this fundamental challenge, decentralized finance can never truly compete with traditional markets, let alone improve upon them.

Why Current Solutions Miss the Mark

Most attempts to address these issues in DeFi focus on the wrong things. Some platforms try to build faster blockchains. Others create token incentives for liquidity providers. While well-intentioned, these solutions fundamentally misunderstand what traders—both institutional and retail—actually need:

1. Certainty of execution price

Current DeFi platforms show "estimated" prices that often don't match execution reality. Large trades can face slippage of 5-10% or more, while automated market maker (AMM) models guarantee price impact for significant orders. This is unacceptable for any serious trader.

2. Privacy of Trading Intent & Guaranteed Execution

There's a crucial difference between transparent markets and exposed trading intentions. Traditional exchanges offer tools like dark pools, hidden orders, and iceberg orders to protect traders while maintaining market integrity. In contrast, DeFi platforms not only lack these tools, but also broadcast every transaction in the mempool before execution. While Robinhood catches flak for sharing order flow with select market makers, DeFi trades are broadcast to the entire network—and worse, let miners and builders completely rewrite the rules of execution. This isn’t just about confidentiality - it’s about guaranteed and deterministic execution. In traditional markets, you know how exactly your orders should be processed. But in most DeFi systems, the path from order submission to execution is subject to interference and manipulation from various actors who can see and react to your order first, potentially reordering, tampering with, or even dropping requests entirely. It’s like being forced to play poker with your cards face up.

3. True cost efficiency at scale

While DeFi often advertises low trading fees, the true cost of DeFi for institutional-scale trading is prohibitive:

- Unpredictable gas fees that can spike during market volatility

- Wide spreads from inefficient market making

- High price impact from shallow liquidity

These layered costs make DeFi derivatives trading untenable for institutional players moving serious size, who are accustomed to paying just a few basis points in traditional venues. The leverage inherent in derivatives markets magnifies every inefficiency - a 5% price impact that might be survivable elsewhere becomes catastrophic at 10x leverage, potentially turning winning strategies into complete losses.

4. Speed and Reliability

Even the fastest DeFi platforms, with 250-millisecond block times, are still 100+ times slower than their centralized counterparts. But raw speed isn't the only issue. Traditional derivatives platforms provide:

- Guaranteed execution acknowledgements

- Predictable settlement times

- Clear transaction finality

- No risk of chain reorgs or uncle blocks

Current DeFi solutions provide none of these crucial features. The focus on marginal speed improvements or liquidity mining programs misses the fundamental market structure requirements that make institutional trading possible. Without addressing these core issues, DeFi will remain unsuitable for serious institutional participation and therefore unable to achieve the liquidity and efficiency needed for mainstream adoption.

Why This Matters for Everyone

What if you’re not an institution, why should you care about any of this?

With the proliferation of automated/electronic trading and increased institutional participation, trading costs have shrunk dramatically across most traditional markets. It turns out, when institutions can participate effectively, everyone wins. When platforms are improperly designed and built, falling short of institutional needs:

- Spreads widen as market makers protect themselves from information leakage or being picked off

- Liquidity becomes shallow, making it harder to trade any meaningful size

- Price discovery suffers, leading to less efficient markets

- Manipulation becomes more prevalent

It's like a city without proper infrastructure—sure, you can still get around, but everything is more difficult and expensive than it needs to be. The presence of institutional traders, when properly structured, creates the "roads and highways" that make markets work efficiently for everyone.

A New Path Forward

The arms race to zero latency has dominated the last decade of traditional market structure evolution. The next decade won’t just be about speed alone, it will be about building markets that are both lightning fast and fundamentally fair.

The blockchain industry's attempts to solve these challenges have been like trying to fix a broken engine by painting the car a different color. The very nature of the typical blockchain Byzantine Fault Tolerant (BFT) consensus makes achieving competitive HFT speeds physically impossible - no matter how many new L1s, L2s, and memecoins feign short-term excitement, they don't address the core issues that would unlock the next phase of adoption.

What's needed isn't another marginal improvement in blockchain technology—it's a fundamental rethinking of how we handle the core activity of any financial market: matching buyers with sellers.

This is where Trusted Execution Environments (TEEs) offer a compelling solution. Think of a TEE as a secure vault for processing trades. TEEs can process trades with ironclad guarantees about execution without requiring trust in an operator themselves.

With TEEs, we can finally deliver what traders require:

- Orders remain private until sequencing and execution, eliminating front-running

- Trade matching happens in microseconds, not 100s of milliseconds

- Guaranteed, tamper-proof execution

And the best part of it, all of this can be done without sacrificing the transparency and verifiability that make decentralized systems powerful.

Most importantly, this solution addresses the market structure challenge at its root. Rather than trying to race against information leakage or compensate for it with incentives, TEEs prevent the leakage from occurring in the first place. It's the difference between constantly mopping up water from a leaky pipe and actually fixing the pipe.

The technology exists today. The question isn't whether we can build these systems—it's whether the industry will acknowledge that serving institutional needs isn't a betrayal of decentralization, but a prerequisite for achieving it. Real adoption requires serving the needs of all market participants, from retail to institutional. Markets should work for everyone.

For the latest updates on platform developments and governance proposals, join the Telegram announcements channel, follow @DDX_official on X, and subscribe to the DerivaDEX Learn email list using field below.