Leveraged positions can be collateralized in two ways: cross margin and isolated margin. Both have their own functionalities and risks.

On DerivaDEX, only cross-margin is currently supported. However, traders can create isolated margin style positions using strategies, a forthcoming feature.

Isolated Margin

Isolated margin enables traders to dedicate collateral to a specific position. On DerivaDEX, collateral is deposited to specific strategies. Each strategy can open multiple positions, for example, BTCP long and ETHP short positions.

However, if a trader opens a new strategy for each position, and deposits collateral to that strategy only, then they have simulated an isolated margin training experience using strategies.

The primary benefit of isolated margin is risk management may be more straightforward. Users can limit the amount of collateral at risk for a more volatile trade, without affecting their existing positions on other trading products.

The primary drawback is that isolated margin may mean individual positions have less collateral available and are thus more leveraged and at risk of liquidation.

Cross Margin

Cross margin is the default setup for trading on DerivaDEX. Collateral is deposited to a specific strategy, and traders can then use this strategy to open multiple positions across all trading products. Cross margin means that all collateral is available to all positions.

The primary benefit of cross margin is capital efficiency. This means profitable positions, if there are any, are automatically contributing to the overall margin and can help prevent liquidation on unprofitable positions, particularly if the price movement is temporary.

The primary drawback of cross margin is that all positions are sharing collateral and are thus interdependent. One unprofitable position could potentially affect all profitable positions and all collateral is at risk of liquidation.

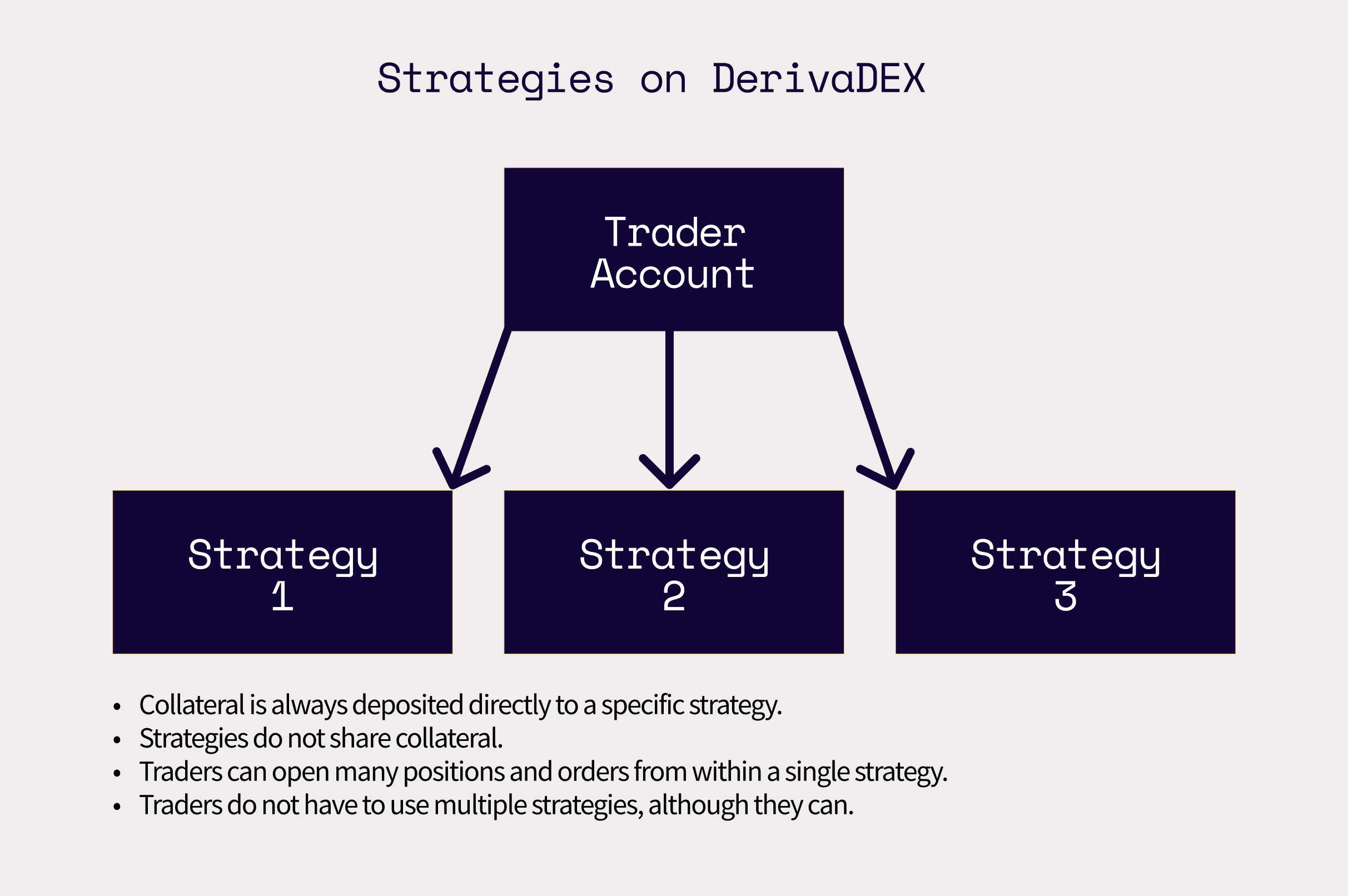

Strategies

A trader can have multiple strategies. When making a deposit on DerivaDEX, a trader must select which strategy they are depositing to. Currently, only one strategy is available to all traders (main). Multiple strategies is a forthcoming feature that enables users to select which position or series of positions they are depositing collateral to.

For example, a user could choose to use one strategy for directional trading on large cap coins, using the majority of their collateral, and another strategy for short-term positions on more volatile tokens, risking a smaller amount of collateral on this more volatile set of products.

Each approach has its own advantages and risks. Traders should make an informed decision about their objectives and use the strategies feature to build risk-aware positions.

The content provided in this article is for educational and informational purposes only and does not constitute financial, investment, or trading advice. The information is presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Trading and investing in financial markets carries substantial risk including the possible loss of principal.